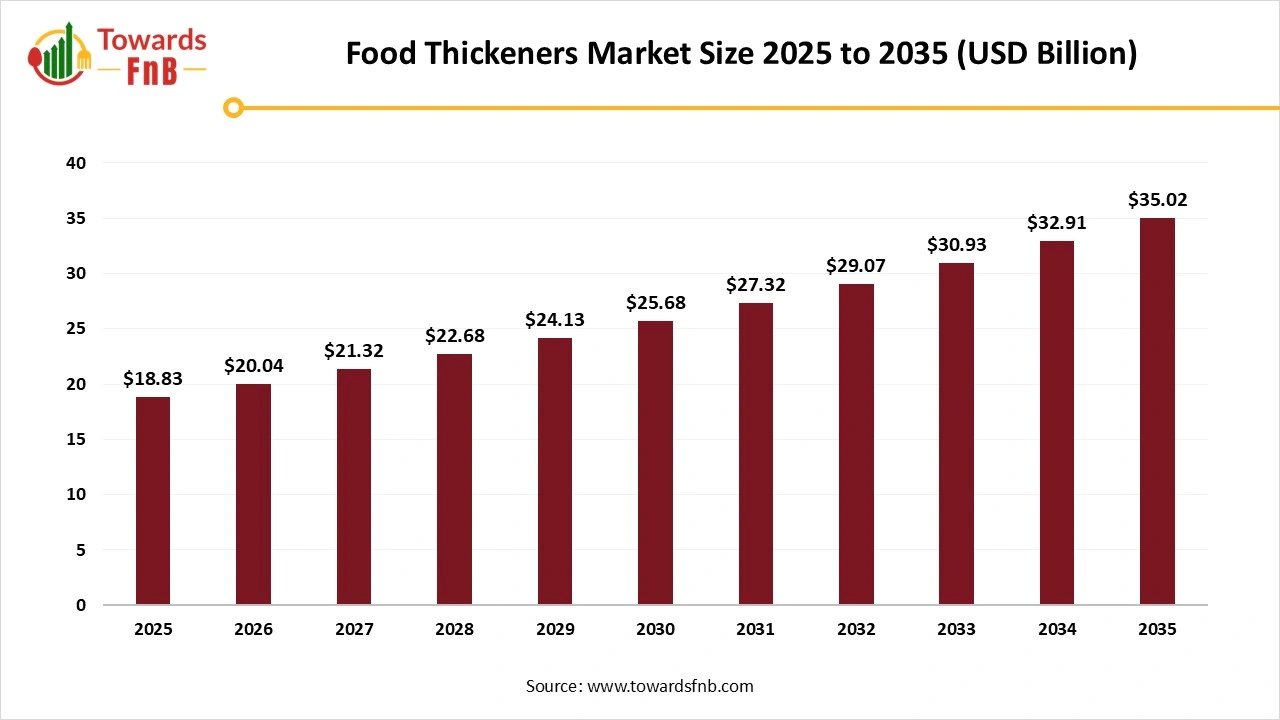

Food Thickeners Market Size to Exceed USD 35.02 Billion by 2035, Driven by Clean-Label, Plant-Based, and Functional Food Demand

According to Towards FnB, the global food thickeners market size is calculated at USD 20.04 billion in 2026 and is forecast to reach USD 35.02 billion by 2035, reflecting at a CAGR of 6.4% from 2026 to 2035. This growth is largely driven by the increasing adoption of clean-label, plant-based ingredients, and the rising demand for functional foods that offer added nutritional benefits and improved textures.

Ottawa, Jan. 16, 2026 (GLOBE NEWSWIRE) -- The global food thickeners market size stood at USD 18.83 billion in 2025 and is predicted to grow from USD 20.04 billion in 2026 to reach around USD 35.02 billion by 2035. A report published by Towards FnB, a sister firm of Precedence Research,

The market is observed to grow due to higher demand for different types of processed food options, sauces, dressings, cream, and spreads. Higher demand for clean-label ingredients and healthier options also helps to fuel the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5973

Key Highlights of Food Thickeners Market

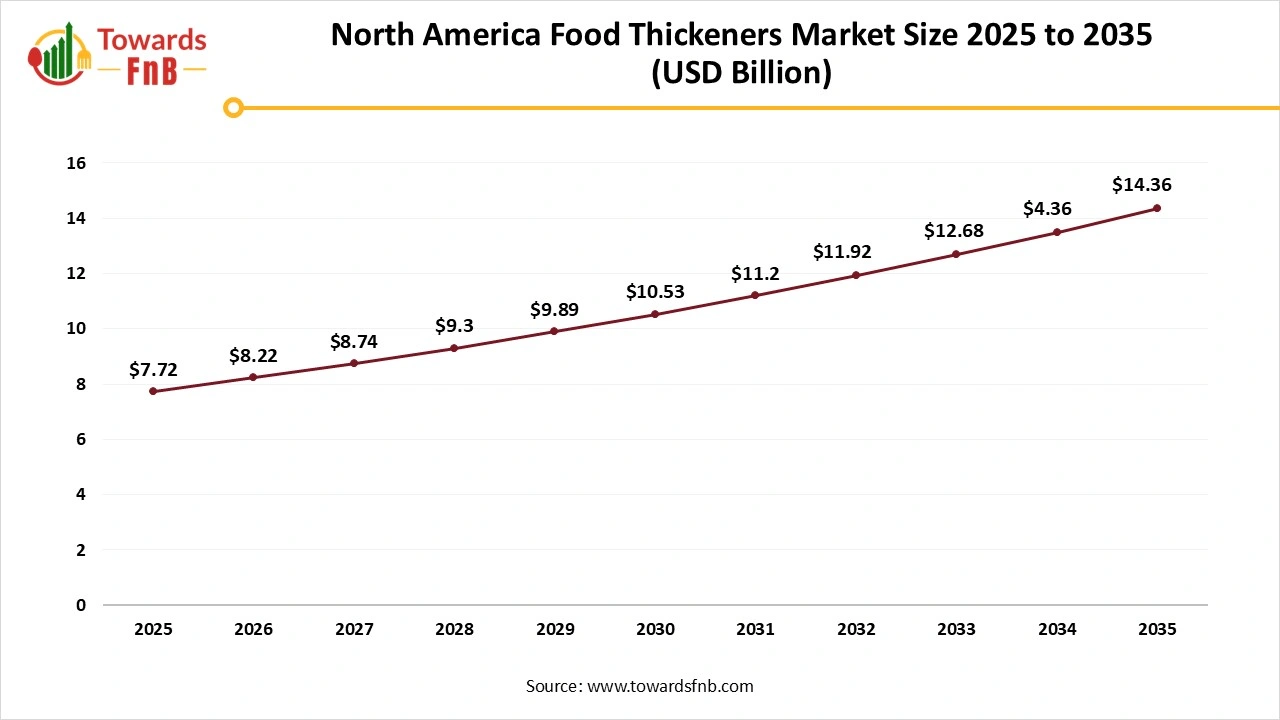

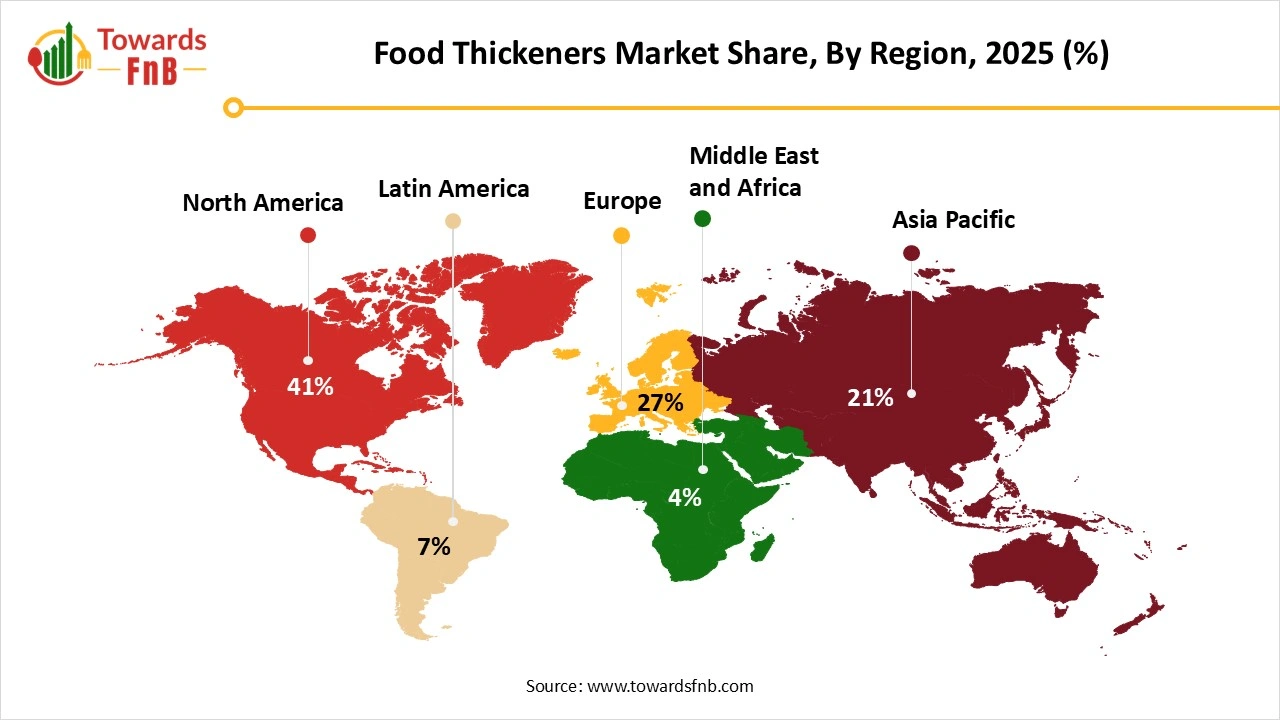

- By region, North America led the food thickeners market with largest share of 41% in 2025, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By type, the hydrocolloids segment led the food thickeners market in 2025, whereas the protein segment is expected to grow in the forecast period.

- By source, the plant-based segment led the food thickeners market in 2025, whereas the animal-based segment is expected to grow in the foreseen period.

- By application, the beverages segment led the food thickeners market in 2025, and the sauces and dips segment is expected to grow in the forecast period.

“Food thickeners are no longer viewed as basic additives, they are strategic formulation tools enabling clean-label compliance, plant-based texture optimization, and shelf-life enhancement across modern food systems,” said Vidyesh Swar, Principal Consultant at Towards FnB. “Manufacturers are increasingly relying on advanced hydrocolloids, protein systems, and fiber-based thickeners to meet evolving consumer expectations without compromising taste or stability.”

Higher Demand for Thickeners is helping to fuel the Growth of the food thickeners industry

The food thickeners market is observed to grow due to higher demand for clean-label and healthier options by vegetarians, vegans, and plant-based diet followers. The growing health and wellness trends leading to higher demand for healthier options, such as organic and fortified foods and beverages, also help propel the market’s growth. Growing demand for protein-rich smoothies, fortified snacks, and nourishing, convenient food options also enhances the market’s growth. The market also observes growth due to higher demand for dairy, bakery, and vegan options at individual levels and in different types of food service industries.

Role of Technology in the Growth of Food Thickeners Market

Developments in enzyme-modified starches, multifunctional hydrocolloids, and improved extraction techniques are some of the technological advancements helpful to enhance the growth of the market. Such techniques help to enhance the taste, texture, mouthfeel, stability, and shelf life of the product. Hence, technology has a major impact on the growth of the market. Improved clean-label formulations and elevated plant-based options for health-conscious consumers also help to fuel the growth of the market.

Impact of AI on the Food Thickeners Market

Artificial intelligence is increasingly used in the food thickeners market to improve formulation precision, functional performance, and batch-to-batch consistency across applications such as sauces, soups, dairy products, beverages, and processed food. Machine learning models analyze large datasets covering rheological behavior, hydration kinetics, temperature sensitivity, and shear response of hydrocolloids such as starches, gums, pectin, and cellulose derivatives to recommend optimal thickener combinations for specific processing and end-use conditions. In product development, AI accelerates the selection of clean-label and low-dosage systems by predicting viscosity curves, mouthfeel perception, and stability under varying pH, salt, and heat treatments, reducing the need for extensive pilot trials. During manufacturing, AI-enabled process control tools monitor parameters such as dispersion efficiency, particle agglomeration, and hydration time to minimize lumping, inconsistency, and yield loss in high-throughput production environments.

AI is also applied in shelf-life and stability modeling, where predictive analytics identify risks of phase separation, syneresis, or viscosity drift during storage and distribution. From a regulatory and safety standpoint, AI supports formulation screening and compliance checks by mapping ingredient usage levels and functionality claims against guidance frameworks referenced by the Food and Agriculture Organization and regulatory oversight applied by the U.S. Food and Drug Administration. Overall, AI functions as a formulation optimization and risk-reduction tool in the food thickeners market, enabling manufacturers to deliver consistent texture, improve processing efficiency, and respond more effectively to clean-label and performance-driven product requirements.

Recent Developments in Food Thickeners Market

- In April 2025, Arkema unveiled a new line of biobased specialty additives. The main aim of the new line focuses on enhancing sustainable coatings and adhesive products.

New Trends in the Food Thickeners Market

- Food and beverage options made from clean-label, recognizable, and easy-to-understand ingredients are one of the major factors for the growth of the market.

- Higher demand for processed and convenient options like bakery, dairy, sauces, dips, and ready-to-eat options also helps to fuel the growth of the market.

- Advanced technology, helpful to maintain the taste, texture, creaminess, and shelf life of the plant-based options with the help of food thickeners, also helps to fuel the growth of the market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/food-thickeners-market

Food Thickeners Market Dynamics

What are the Growth Drivers of Food Thickeners Market?

Higher demand for processed and convenient food options is one of the major factors for the growth of the market. A growing health-conscious population, leading to higher demand for plant-based and healthier alternatives, is another vital factor for the growth of the market. Technological advancements are helpful to enhance the food thickener quality, which helps manage the taste, texture, mouthfeel, and shelf life of food and beverages, and also helps to fuel the growth of the market. Versatility leading to higher demand for thickeners in different domains, such as medical, food, and beverages, also helps to fuel the growth of the market.

Regulatory Hurdles Hampering the Growth of the Market

Issues in the approval of new and different types of ingredients used for the manufacturing of food thickeners are one of the major issues in the growth of the market. Regional hurdles for approval of certain ingredients also restrain the growth of the market. Difficulty in approval and usage of plant-based alternatives also hampers the growth of the market. Hence, such issues altogether may slow the growth of the market.

Higher Demand for Vegan and Plant-Based Options Is Fueling the Growth of the Food Thickeners Market

The growing population of health-conscious consumers leading to higher demand for plant-based, organic, fortified, and vegan options is one of the major opportunities for the growth of the market. Higher demand for plant-based and innovative food thickeners made from citrus fiber and tapioca starch also elevates the growth of the market.

Product Survey of the Food Thickeners Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Starch-Based Thickeners | Increase viscosity and body through starch gelatinization and hydration | Native starches, modified food starches, resistant starches | Soups, sauces, gravies, ready meals | Modified starch thickening systems |

| Hydrocolloid Thickeners | Thicken and stabilize aqueous systems through water binding and gel formation | Xanthan gum, guar gum, locust bean gum, carrageenan | Dressings, dairy desserts, beverages | Hydrocolloid stabilizer blends |

| Cellulose-Based Thickeners | Provide viscosity, suspension, and mouthfeel with heat stability | CMC, MCC, HPMC | Sauces, bakery fillings, processed foods | Cellulose derivative thickeners |

| Protein-Based Thickeners | Enhance thickness and texture through protein hydration and network formation | Whey protein, gelatin, egg protein systems | Dairy products, desserts, confectionery | Protein-based texturizing agents |

| Pectin Thickeners | Form gels and provide viscosity in high- and low-sugar systems | High-methoxyl pectin, low-methoxyl pectin | Jams, fruit preparations, beverages | Fruit-derived pectin systems |

| Alginates | Thicken and gel in the presence of calcium ions | Sodium alginate, calcium alginate blends | Reformed foods, sauces, culinary applications | Alginate gelling systems |

| Agar and Carrageenan | Seaweed-derived thickeners providing gel strength and clarity | Agar agar, kappa and iota carrageenan | Confectionery, dairy, plant-based products | Marine hydrocolloid thickeners |

| Clean-Label Thickeners | Thickeners formulated to meet clean-label and natural positioning | Native starches, citrus fiber, oat fiber | Clean-label food brands, premium products | Clean-label thickening solutions |

| Instant Thickeners | Rapidly hydrate to thicken without heat | Pre-gelatinized starches, instant gums | Convenience foods, instant mixes | Instant thickening agents |

| Specialty Beverage Thickeners | Control viscosity and suspension in liquid systems without clouding | Beverage-grade gums and stabilizers | Functional drinks, nutritional beverages | Beverage viscosity control systems |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5973

Food Thickeners Market Regional Analysis

North America Dominated the Food Thickeners Market in 2025

North America led the food thickeners market in 2025, due to higher demand for convenient, processed, packaged, and ready-to-eat food and beverage options. They are highly demanded by consumers with a time crunch to grab a nutritional bite without much preparation time. Availability of technologically advanced food and beverage processing machinery and higher demand for plant-based, functional, and organic thickening options also help to enhance the growth of the market.

The US has made a major contribution to the growth of the market due to higher demand for healthier options and higher demand for thickeners in different domains such as food and beverages and medical purposes, which also help to fuel the growth of the market.

Asia Pacific Is Observed to Be the Fastest-Growing Region in the Foreseeable Period

Asia Pacific is observed to be the fastest-growing region in the foreseen period due to rapid urbanization, growing disposable income, and higher demand for healthier and plant-based options in the region. Rising consumption of processed, packaged, ready-to-drink beverages and convenient food options also helps to fuel the growth of the market. India has made a major contribution to the growth of the market due to higher demand for ready-to-use sauces, dips, dairy, and ready-to-drink beverages in the region, fueling the demand for the growth of the food thickeners market in the foreseeable period.

Europe is Observed to Have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period due to higher demand for clean-label ingredients, sustainable sources, naturally sourced ingredients, and plant-based thickening options. Strict regulatory policies for food hygiene and safety are another major factor for the growth of the market. Germany has made a major contribution to the growth of the market due to higher demand for beverages, bakery, dairy, and dairy alternatives in the region, fueling the growth of the market.

Trade Analysis for the Food Thickeners Market

What Is Actually Traded (Product Forms and HS Proxies)

- Starch-based thickeners, including native starches and modified food starches used in sauces, soups, and processed foods, are commonly traded under HS 1108 and HS 3505 depending on modification level.

- Hydrocolloids of plant origin, such as guar gum, locust bean gum, and tara gum, are typically classified under HS 1302 (vegetable saps and extracts; pectic substances; agar; gums).

- Seaweed-derived thickeners, including carrageenan and agar, are commonly traded under HS 1302 when supplied in purified or semi-refined form.

- Pectin used as a thickener and gelling agent in fruit preparations and dairy applications is generally classified under HS 1302.

-

Composite thickener systems and stabilizer blends, combining multiple hydrocolloids and starches, are usually cleared under HS 2106 as food preparations not elsewhere specified.

Top Exporters (Supply Hubs)

- China: Major exporter of modified starches, guar derivatives, and composite thickener systems supported by large-scale processing capacity and cost competitiveness.

- India: Leading exporter of guar gum and guar-based thickeners, supported by domestic guar seed production and processing clusters.

- Germany: Exporter of specialty food thickeners and stabilizer systems aligned with high regulatory and formulation standards.

- France: Exporter of pectin and hydrocolloid systems used in dairy, bakery, and fruit-based applications.

Top Importers (Demand Centres)

- United States: Significant importer of specialty thickeners and stabilizer blends used in processed foods, dairy, and ready meals.

- European Union: Strong intra-EU and extra-EU imports driven by processed food manufacturing and reformulation requirements.

- Japan: Imports high-purity thickeners for texture-sensitive convenience foods and beverages.

- Southeast Asia: Growing imports linked to expansion of packaged foods, sauces, and instant meal production.

Typical Trade Flows and Logistics Patterns

- Bulk starches and hydrocolloids are shipped via containerized sea freight from origin processing hubs.

- Moisture-sensitive thickeners are transported using sealed, humidity-controlled packaging.

- High-purity or specialty hydrocolloids may be shipped in smaller consignments to preserve functional consistency.

- Regional blending and repackaging facilities adapt thickener systems to local formulation needs.

Trade Drivers and Structural Factors

- Processed food growth sustains demand for texture-modifying ingredients across multiple categories.

- Reformulation pressure drives replacement of fats and synthetic additives with hydrocolloid-based systems.

- Shelf-life and freeze-thaw stability requirements increase reliance on advanced thickener blends.

- Cost volatility in raw agricultural inputs influences sourcing and trade flows.

- Standardized formulations by multinational food producers concentrate demand among approved suppliers.

Regulatory, Quality, and Market-Access Considerations

- Food thickeners must comply with additive regulations, purity specifications, and usage limits set by food safety authorities.

- Labeling requirements influence classification as additives or ingredients depending on jurisdiction.

- Seaweed- and microbial-derived thickeners may require additional traceability documentation.

- Import clearance requires technical data on composition, allergen status, and manufacturing controls.

Government Initiatives and Public-Policy Influences

- Food safety and additive harmonization initiatives influence approval pathways and trade access.

- Nutrition and clean-label policies indirectly stimulate demand for natural thickening agents.

- Trade facilitation measures and customs procedures affect cross-border movement of food ingredients.

Food Thickeners Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 6.4% |

| Market Size in 2026 | USD 20.04 Billion |

| Market Size in 2027 | USD 21.32 Billion |

| Market Size in 2030 | USD 25.68 Billion |

| Market Size by 2035 | USD 35.02 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Food Thickeners Market Segmental Analysis

By Type Analysis

The hydrocolloids segment dominated the food thickeners market in 2025, due to its versatility, water-binding properties, and texture-enhancing properties, which are helpful to enhance the demand for sauces, dressings, bakery, and beverages, also helping to fuel the growth of the market. Higher demand for healthier, plant-based, organic, and functional options by health-conscious consumers is another major factor for the growth of the market. The segment also focuses on enhancing the quality and shelf life of the product.

The protein segment is observed to be the fastest-growing region in the foreseen period due to higher demand for protein-based snacks and food and beverage options, fueling the growth of the market. The market also observes growth due to higher demand for automation for protein extraction, coupled with innovation, positioning protein-based thickeners, further fueling the growth of the market in the foreseeable period.

Source Type Analysis

The plant-based segment dominated the food thickeners market in 2025, due to a growing health-conscious population fueling the demand for plant-based, organic, functional, and healthier options, which fueled the growth of the market. The growing population of vegans and vegetarians also helps to fuel the growth of the market. Such plant-based thickeners are derived from ingredients such as corn, guar, locust bean, and seaweed. They help to enhance the taste, texture, stability, and versatility of various food options, fueling the growth of the market.

The animal-based segment is expected to grow in the foreseen period due to higher demand for thickening substances such as gelatin and other protein-based thickeners. It helps to provide stability, thickening, and easy gelling, further fueling the growth of the market globally. Higher demand for such thickeners in domains such as food and beverages, pharmaceuticals, dairy, and confectionery also helps to fuel market growth in the foreseen period.

Application Analysis

The beverages segment led the food thickeners market in 2025, due to higher demand for beverage options such as smoothie, thick shakes, and other nourishing drinks. Higher demand for plant-based and healthier choices also helps to fuel the growth of the market. Thickeners help to enhance the shelf life, mouthfeel, taste, and texture of such beverages, further fueling the growth of the market. Higher demand for protein-enriched and dairy alternatives also enhances the growth of the market.

The sauce and dips segment is expected to grow in the foreseen period due to higher demand for sauces and dips in ethnic, fast food, and clean-label recipe options. Higher demand for healthier and plant-based sauces by health-conscious consumers also helps to fuel the growth of the market. Such thickeners help to enhance the taste, texture, mouthfeel, and shelf life of such sauces and dips, which is helpful for the growth of the food thickeners market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Dietary Supplements Market: The global dietary supplements market size is projected to reach USD 507.33 billion by 2035, growing from USD 229.77 billion in 2026, at a CAGR of 9.2% from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Top Companies in the Food Thickeners Market and Their Strategic Advantages

- Ingredion Incorporated: Ingredion leads in clean-label, plant-based ingredients, offering a range of starches and hydrocolloids. With a strong focus on sustainability and R&D, they cater to the growing demand for healthier food solutions, helping manufacturers improve texture, stability, and shelf life in food products.

- Tate & Lyle PLC: Tate & Lyle is known for its sugar reduction and texture improvement solutions. By providing plant-based thickeners, they meet the increasing consumer demand for functional foods and clean-label products, positioning themselves as leaders in healthier eating trends globally.

- Ashland: Ashland specializes in high-performance hydrocolloids that improve the taste and texture of food products. Their focus on plant-based solutions enables them to meet the demand for organic and sustainable ingredients, particularly in dairy alternatives and vegan formulations.

- FDL Limited: FDL offers cost-effective thickeners for key categories like sauces, dairy, and ready meals. Their ability to provide customizable solutions helps manufacturers meet the demand for clean-label products, with a strong focus on organic food options.

- Naturex S.A.: Part of Givaudan, Naturex specializes in plant-based thickeners for natural and organic food products. With Givaudan’s innovation capabilities, they lead in clean-label solutions and meet the rising demand for vegan and gluten-free ingredients.

- Medline Industries, LP: Medline provides food thickeners for medical nutrition, particularly for patients with dysphagia. Their focus on healthcare ingredients positions them to expand in the medical nutrition sector, tapping into a growing market for clinical applications.

-

Darling Ingredients: Darling specializes in sustainable, animal-based thickeners like gelatin and collagen. Their sustainable sourcing and eco-friendly solutions give them a competitive edge in meeting dairy-free and clean-label market demands while optimizing their supply chain.

Segment Covered in the Report

By Type

- Protein

- Starch

- Hydrocolloids

- Gelatin

- Xanthan Gum

- Agar

- Pectin

- Others

By Source

- Animal

- Plant

- Microbial

By Application

- Bakery

- Confectionery

- Sauces & Dips

- Beverages

- Convenience & Processed Food

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5973

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.